2023 | SECOND QUARTER

A Message from Our CEO

Hello again! It’s hard to believe more than half of the year has already gone by. I’m sure there have been many exciting events in your lives, as there are here in the insurance world.

As usual, you’ll find in this quarterly report several updated stats regarding the growth of your insurance company (Tower Hill Insurance Exchange). Your insurance company continues to grow, but I know many of you would like us to grow a little bit more. I’m often asked this question: “How can my neighbor or my relative become a Tower Hill Exchange member?” Quite frankly, we would love to insure everyone who wants to become an Exchange member, but we are taking a more conservative approach to growth to ensure the security of your company. Nonetheless, if your friend or family member was not approved to join Exchange when they first applied, please encourage them to try again. We re-evaluate market conditions from time to time, which often results in additional opportunities for welcoming new Exchange members.

Speaking of market conditions, Florida homeowner’s insurance market has been and continues to be in the news quite often. The challenging market conditions in Florida have caused several private insurance carriers to close their doors or stop writing in the state altogether. Just recently, a few more carriers announced they are stopping or reducing business in Florida. Those carriers remaining are faced with record increases in reinsurance costs this year (reinsurance is insurance for the insurance companies).

However, there is good news on the horizon! Insurers are closely monitoring recent legislative changes enacted to help control runaway litigation costs and exaggerated claims costs. While it’s too early to tell, we are hopeful these changes will improve the market conditions and encourage more insurers to come back to Florida.

Here at Tower Hill, we’ve been in Florida for 51 years, and we don’t plan to leave. We have weathered storms with you for over five decades. We also want a healthy competitive insurance marketplace, so customers can have a choice. Competition makes all of us better. It’s up to all of us to do our parts to restore the shine in the Sunshine State when it comes to homeowner’s insurance availability and affordability.

Speaking of weathering storms, we are now in the midst of hurricane season. Costly hurricane losses in Florida would certainly not help the marketplace. As a responsible homeowner, you can do your part by taking certain steps to mitigate losses in the event of a storm. In this quarter’s update, we have included links to helpful articles to help you prepare for stormy weather and keep your family safe. Please take some time to review these helpful tips and resources.

Let me close by again saying Thank You for placing your trust in us. We are proud to be your insurer and proud to serve our Florida customers for over 51 years. Until next time, stay safe and enjoy the rest of your summer!

Tell Us What You Think! Would you recommend us to your friends and colleagues? Is there something we could be doing better? Let us know by taking our Member Care Survey.

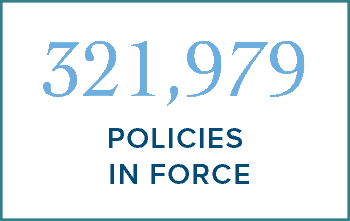

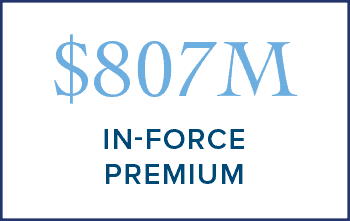

Quarterly Stats*

*Results as of June 30, 2023

Exchange Insight

Reinsurance

Tower Hill Insurance Exchange completed our Florida reinsurance program ahead of the June 1, 2023 renewal date. Exchange has secured close to $2 billion in catastrophe reinsurance cover to protect the reciprocal in excess of rating agency requirements, including all perils. This coverage includes $120 million more limit than the expiring program and protects our policyholders to a similar level. We partnered with nearly 40 top-rated reinsurers on this year’s program to secure combined reinsurance coverage at nearly a 140-year Probable Maximum Loss (PML) for a single event.

Tower Hill Insurance Exchange completed our Florida reinsurance program ahead of the June 1, 2023 renewal date. Exchange has secured close to $2 billion in catastrophe reinsurance cover to protect the reciprocal in excess of rating agency requirements, including all perils. This coverage includes $120 million more limit than the expiring program and protects our policyholders to a similar level. We partnered with nearly 40 top-rated reinsurers on this year’s program to secure combined reinsurance coverage at nearly a 140-year Probable Maximum Loss (PML) for a single event.

As you’ve likely seen in the media, reinsurance prices have increased significantly the last several years. Unfortunately, increased reinsurance costs for Exchange result in higher premium rates for its members.

We recognize the challenges higher rates mean for our members, so we’re making every effort to help you reduce overall premiums through a combination of deductible options and available discounts. Please consult with your insurance agent to ensure you’re taking advantage of the credits and budget options that may be available for your Exchange policy.

Do College Students Need “Home” Insurance?

If you have college students in your family who live in a dorm or off campus, make sure they have the necessary insurance coverage while away from home. Even for your kids attending college out of state, as long as their legal residence is still considered your home and you are providing financial support, typically he/she is insured under your homeowners (HO3) policy as a resident relative.

For most HO3 policies, the following coverages are applicable to college students qualifying as a resident relative under your policy.

For most HO3 policies, the following coverages are applicable to college students qualifying as a resident relative under your policy.

PERSONAL PROPERTY (COVERAGE C)

Whether in a dorm or off-campus apartment, items such as furniture, clothing, a laptop computer, etc. would be covered for damage caused by one of the HO3 policy’s covered perils. This type of coverage is under Personal Property Coverage (Coverage C), and generally only 10% of the policy limit is available for college students in a dorm or off-campus residence.

EXAMPLE: If your Personal Property Coverage limit is $100,000 then only 10%, or $10,000, is available.

Even though theft is a covered peril, coverage for theft only applies if your college student has been at the college residence within the last 45 days. For students spending the semester abroad or away from their dorm or apartment for an out-of-town summer internship, any items they left in their college residence may not be covered.

LIABILITY (COVERAGE E)

The limit for liability (Coverage E) is available for your college student away from home, even worldwide. However, be sure to familiarize yourself with what liability coverage may or may not cover (i.e., exclusions) ahead of time. Generally there is no liability coverage included for damage caused to property rented or occupied by the insured (i.e., the residence itself).

LOSS OF USE (COVERAGE D)

The Coverage D limit for loss of use is available to the student when personal property is covered. If your student’s college residence is temporarily uninhabitable, such as due to hurricane damage, the costs to rent another home for a few weeks or the rest of the semester can add up quickly. Loss of use coverage reimburses for these extra expenses, such as lodging, travel to campus, and meals.

Remember, if your home is no longer legally considered your college student’s residence (i.e., their driver’s license address doesn’t match your home address), then they’re not covered under your homeowners policy while away at school. Play it safe and check with your insurance agent to be sure you’ve purchased the coverage that best fits your family’s individual needs.

The National Retail Federation (NRF) predicts 2023 will be the most expensive back-to-school shopping season ever. The NRF estimates families with college age students will spend an estimated $94 billion, about $20 billion more than last year’s record. This is an average of $1,366.95 per person, more than $167 higher than last year. NRF reports electronics spending for back-to-college students will rise 12%.

© 2023 American Property Casualty Insurance Association (APCIA). All Rights Reserved.

Hurricane Season

We’re quickly approaching what is traditionally the most active portion of the season for the Atlantic Basin. As you may have seen in the media, the National Hurricane Center (NHC) launched a new modeling system that is expected to help improve forecasts for named storms. For the last several years, the NHC’s Hurricane Analysis and Forecast System has been used along with existing hurricane models.

The Hurricane Modeling and Prediction Program is part of the National Oceanic and Atmospheric Administration’s (NOAA) research division.

The Hurricane Modeling and Prediction Program is part of the National Oceanic and Atmospheric Administration’s (NOAA) research division.

According to meteorologists familiar with the advanced system, it helps predict rainfall levels and wind speeds with greater accuracy. Integral to the system’s features is its “moving nest”, which provides high-definition imagery allowing the forecast team to zoom in closely to specific aspects of the hurricane. Satellites, Global Positioning System (GPS), and radar data, along with measurements detected using the famous Hurricane Hunter aircraft, are integrated into the model.

LATEST FORECASTS

When meteorologists mention the El Niño weather pattern, usually they’re referring to the higher chance for weaker hurricanes in the Atlantic Ocean. However, Atlantic Ocean water temperatures are unusually warm this season. According to most forecasts, higher temperatures may negate the usual impact of El Nino and result in stronger storms instead.

In early July, Colorado State University (CSU) increased its 2023 hurricane forecast to an above-average season. CSU is now forecasting 18 named storms, of which half are expected to become hurricanes. Based on the team’s latest forecast, four hurricanes are expected to be considered major with winds exceeding 110 miles per hour, measured by the Saffir-Simpson Hurricane Wind Scale as Categories 3, 4 or 5. In August, NOAA also increased its forecast to an above normal hurricane season this year, with between two and five storms reaching Category 3 or higher.

Although 2022 was forecast as fairly average, it included Hurricane Ian that struck Florida’s West Coast at nearly the Category 5 level. Hurricane Ian is now considered the third most expensive hurricane on record. This year, the season’s first named storm was Arlene on June 2nd. July had a few systems form, but none made landfall. Besides damage from wind and rain, storm surge flooding can cause significant damage, as we saw with Hurricane Ian.

STAY SAFE

While Mother Nature can always be unpredictable, by preparing for hurricane season you can protect your home and family. Become familiar with evacuation routes and plan ahead by having a hurricane kit and go bag ready. Be sure to follow local weather alerts, storm warnings and evacuation recommendations so you can stay safe. Visit the Learning Center on THIG.com for hurricane preparation tips for your home, family and pets.

Exchange Testimonial

“Because I lived in the state of Florida and wanted somebody that represented the state of Florida. Too many times the insurance companies were from someplace else and had no idea what it was like to live in Florida.”

“Because I lived in the state of Florida and wanted somebody that represented the state of Florida. Too many times the insurance companies were from someplace else and had no idea what it was like to live in Florida.”

A Tower Hill policyholder for more than a decade, Pamela A. has lived in Florida for more than 50 years. She currently lives in Valrico, Florida, and is retired from the television and banking industries.

Pamela has had a unique and close-up view of the Florida shoreline and towns from the seat of her beloved motorcycle. Although, she’s made the difficult decision to retire from riding her motorcycle … at least for now.

When asked why she’s a Tower Hill Exchange member, the answer is simple. “If I ever needed Tower Hill, I know they would be there…. Every time I’ve called Tower Hill, there’s always been a pleasant person on the other end to help me with what I need.”

At Tower Hill, we’ve been providing peace of mind to Floridians since 1972. We’re committed to being there when you need us all year round, not just during hurricane season. Our Tower Hill Team is dedicated to service excellence with a personal touch. Thank you, Pamela, for sharing your Tower Hill experience.

We’d love to hear your Exchange story! Please send us an email at info@thig.com.

© 2023 Tower Hill Insurance Group, LLC | PO Box 147018, Gainesville, FL 32614 | 800.342.3407 | THIG.com