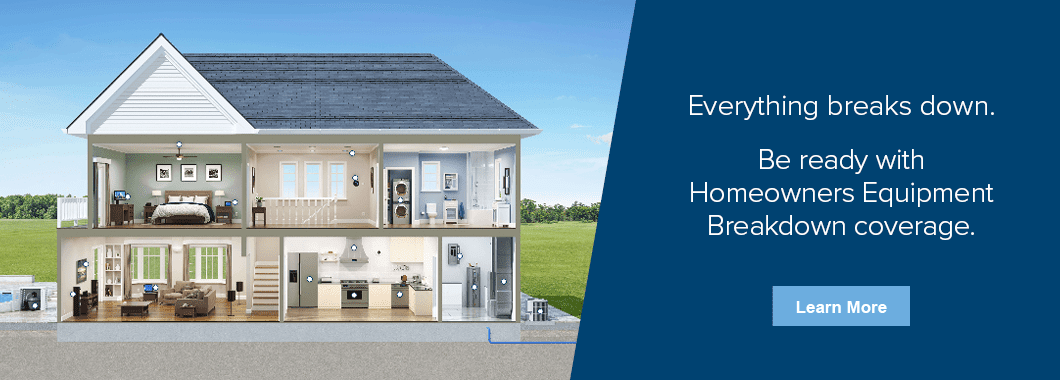

Tower Hill is pleased to offer an alternative to home warranty plans. Equipment Breakdown coverage is now available through your homeowners insurance policy for only $50/year. If you’re a homeowner with a Tower Hill policy, you now have the option to have your equipment breakdown exposures covered.

Check out our interactive experience to see how your home can be protected, or contact us to add Equipment Breakdown coverage to your policy today!

Why do you need Equipment Breakdown coverage?

If it uses electric power, it is most likely subject to equipment breakdown. Often this equipment requires sophisticated diagnostic tools and skilled technicians to oversee a potential repair. Equipment Breakdown coverage protects you against unexpected repair or replacement costs due to an electrical, mechanical, or pressure systems breakdown.

How do I add Equipment Breakdown coverage to my policy?

"*" indicates required fields