Below we’ve included answers to frequently asked questions about selecting a contractor, repairs, claim payments, deductibles, reimbursements for additional living expenses, and more.

Who should I call to make repairs?

CastleCare 844-TOWER-11

Exclusively for Tower Hill customers, CastleCare, powered by Alacrity Solutions, is a credentialed contractor network program available to help at 844-TOWER-11 (844-869-3711). CastleCare provides roofing, mold remediation, contents pack-out, and general contracting repair companies available to help. The program provides both convenience and quality assurance. Warranties on completed projects —1 year for materials and 5 years for workmanship — are provided. If you already know of a reputable licensed contractor in your area, you can choose to hire them instead of using CastleCare. If you receive repair estimates from a contractor other than through CastleCare, please provide the estimates to your claim adjuster for review.

When will I receive my claim payment?

We’ll initiate your claim payment when your inspection report has been completed.

Whenever possible, we’ll initiate the digital claim payment process using ClaimsPay® by One Inc. when your claim has been reviewed in-house or at the time of your on-site inspection. However, depending on the extent of the damage additional information may be required to complete the inspection report. If we are unable to provide the inspection and payment on the spot, we’ll contact you within 7 business days to discuss the next steps.

What is ClaimsPay by One Inc.?

Tower Hill has partnered with One Inc. to provide you with access to a digital option for claim payments via direct deposit, PayPal or Venmo.

If your claim is eligible for the ClaimsPay by One Inc. digital payment option, you’ll receive an email directly from One Inc. Using your mobile or desktop device, you can quickly and easily approve the payment amount and select the electronic funds transfer (EFT) method you prefer. Printed checks sent by USPS mail are also an option for all claim payments; not all claims are

eligible for ClaimsPay by One Inc..

How do I find out the status of my claim?

Your claims status is available online on your Tower Hill Customer Portal account.

Check the status of your claim 24/7 online using your Tower Hill Customer Portal account at THIG.com/Portal. With any questions, please contact our Customer Care Center.

What is a deductible?

A deductible is the amount that you are responsible for, and it’s usually deducted from the claim payment.

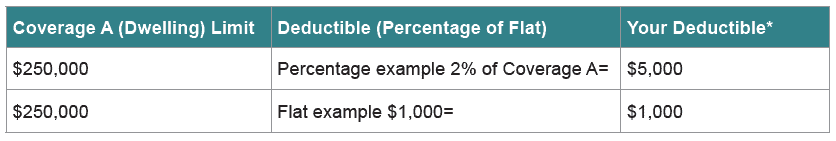

Your deductible amount may vary based on your individual policy coverages and the type of damage to your home or property. A hurricane deductible only applies if the storm-related damage occurs during a hurricane named by the National Hurricane Center (NHC) or the National Weather Service. The deductible can be either a percentage of your Coverage A (Dwelling) limit or a flat dollar amount. Here’s an example:

If my total damage is less than my deductible, should I still file a claim?

It is recommended that you report hurricane damage to Tower Hill as it occurs.

The hurricane deductible is an aggregate amount and only applied once during the calendar year. No matter how many storms damage your home in one calendar year (January to December), you are only responsible for the deductible once between January and December of the same year. After you have met your hurricane deductible for a calendar year, the All Other Perils (AOP) deductible will apply for each subsequent loss.

Because of the severe damage to our home, we have been unable to live there. Will we be reimbursed for living expenses?

Please call your claim adjuster for assistance; we’re here to help!

If you’re unable to live in your home due to storm damage or during the repair process, please contact your claim adjuster. Based on the terms of your insurance policy, your adjuster can explain your Additional Living Expenses (ALE) options for covering the cost of alternate housing and other expenses. We can also refer you to a relocation service.

Please be sure to keep your receipts for costs that may be eligible for ALE reimbursements. Types of expenses include the following: lodging or rental costs; moving and/or storage costs; restaurant meals, etc. Upload copies of your receipts, short-term leases, or any other documents pertaining to additional living expenses to your account at THIG.com/Portal, or email to Tower Hill at claims@thig.com. Please be sure to include your claim number in the subject line.

Although some repairs have been made, there are additional costs for completion.

Provide supporting documents to request supplemental payments.

To support the additional amount needed for repairs, you can provide documentation to Tower Hill (i.e., receipts, estimates, etc.) for review. Upload documents supporting your supplemental request to your Customer Portal account at THIG.com/Portal OR send via email to claims@thig.com. Be sure to include your claim number in the email subject line.

If I cannot reach an agreement with my insurance company about the cost to repair damages, what’s my next step?

Florida’s mediation program is an option.

The Florida Department of Financial Services (FLDFS) offers a mediation program, in which Tower Hill participates. The program is available at no cost to the policyholder. Should you have a conflict with your insurance company, please contact the Florida Department of Financial Services at 877-MY-FL-CFO (877-693-5236). Or you can send us a written request for a FLDFS mediation.