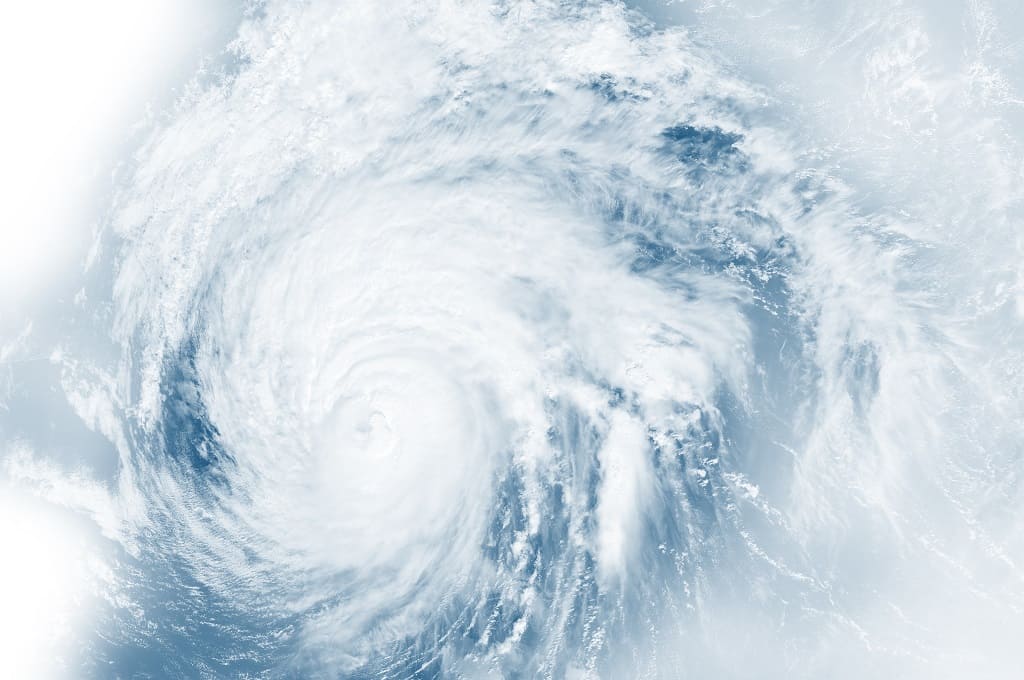

The 2017 storm season was one to remember. What impacts will it have on the insurance industry in the year ahead?

Tower Hill President Don Matz

The $136 billion in insured losses is the third largest annual insured loss since Swiss Re’s sigma unit began tracking worldwide losses. The approximately $90 billion in insured losses resulting from Hurricanes Harvey, Irma, and Maria (HIM) made 2017 the second costliest hurricane season after 2005, in which Hurricanes Katrina, Rita, and Wilma made landfall in the U.S.

Closer to home, the obvious question is “What will be the impact upon future Florida property insurance rates due to the losses incurred in 2017?” The obvious answer is, “Time will tell.” However, here are several key factors to keep in mind.

- Actual hurricane losses are not part of an insurance company’s annual rate filing in Florida. Instead, a long-term expected average annual hurricane loss is utilized. This annual average hurricane loss remains relatively consistent year-over-year, provided all other company factors remain constant.

- Most Florida homeowners’ insurers rely heavily upon the Florida Hurricane Catastrophe Fund (FHCF) for a significant portion of their reinsurance protection. Depending upon the company, the FHCF comprises 25-75 percent of a carrier’s reinsurance program. Unless the Florida Legislature takes some unanticipated action in early 2018, the FHCF is expected to provide the same amount of limit (protection) for the same price as 2017.

- The cost of reinsurance is a component of an insurance company’s annual rate filing. There is no question that reinsurers will be looking to increase the rates they charge their insurance company clients in an attempt to recoup the losses suffered in 2017. Mitigating the amount of rate increase reinsurers can obtain is the presence of third-party capital in the reinsurance industry. This capital has become more prominent over the last 5-6 years and has driven reinsurance pricing down as it has competed with traditional reinsurers. If this capital continues to flow into the reinsurance space unabated, reinsurance price increases will be significantly tempered. If this capital slows or possibly withdraws from the space, reinsurance price increases will be more significant.

- The commercial hurricane models that most insurers rely upon for measuring their potential hurricane losses and, subsequently, how much reinsurance coverage they need to purchase are usually updated after significant hurricane events in an effort to better calibrate model output to actual losses sustained. These models are also responsible for projecting a company’s average annual hurricane loss referred to in #1 above. Model updates generally happen over the course of a year or two. Any updates must be approved by the Florida Commission on Hurricane Loss Projection Methodology before companies can utilize the updated model output in their annual rate filings.

In the near term, the statewide increase in water losses and resulting Assignment of Benefit (AoB) claims will have a greater impact upon homeowners’ insurance rates in Florida than recent hurricane losses and any resulting reinsurance price increases. While hurricanes are clearly beyond the control of insurance companies and their policyholders, many water losses may be eliminated and/or mitigated through regular routine maintenance. Visit the THIG.com Learning Center for some helpful tips on reducing a potential water loss in your home.

From everyone here at Tower Hill, we hope you had a very Merry Christmas and wish you a Happy New Year!